The FTSE 100 Index went parabolic this week and reached its all-time igh of £9,140. It has now surged by over 21% from its lowest level in April, meaning that it has now moved into a bull market.

The Footsie jumped as investors reacted to some important corporate earnings, especially Lloyds Bank and BT Group. This trend will continue next week as some of the biggest FTSE 100 constituents publish their financial results. Some of the most notable ones to watch will be HSBC, Unilever, Rolls-Royce Holdings, and IAG.

HSBC (HSBA)

HSBC, the biggest European banking group by assets, has been on a strong surge this year. Its stock soared to a high of 960 this week, meaning it has jumped by nearly 40% from the lowest level in April. It has jumped by 565 in the last 12 months.

HSBC stock price has soared in line with the ongoing surge in European bank stocks. It also jumped because of the relatively high interest rates in the UK and other markets it operates in, like Hong Kong. High rates lead to a higher net interest margin.

The company has also benefited from its cost reductions and its ongoing momentum in the wealth management industry. Analysts expect the company to publish strong results, and possibly announce a large share buyback, worth possibly about $3 billion.

In line with this, investors will pay close attention to Standard Chartered, a similar banking group with a lot of operations in Asian countries.

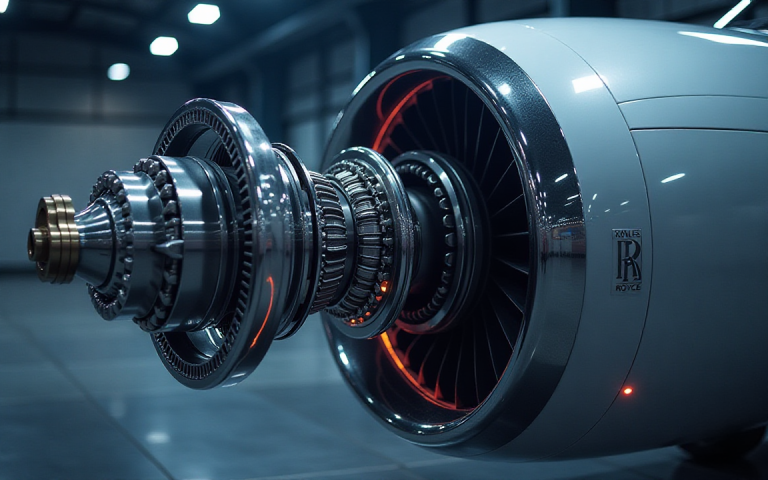

Rolls-Royce Holdings (RR)

Rolls-Royce share price has been in a strong surge this year, mirroring the performance of other industrial giants like GE, Vernova, and GE Aerospace. The company’s business has benefited from tailwinds in the energy, military, and aviation industries. Aviation growth has accelerated, with airlines making robust orders, while energy is benefiting from the ongoing data center demand. Defense spending is increasing after Donald Trump pressured NATO countries to boost it to 5% of GDP.

The Rolls-Royce share price will likely continue thriving as it will likely boost its forward guidance. A likely situation is where it hikes its operating profit guidance from between £2.6 billion and £2.7 billion to £2.9 billion and £3 billion.

Read more: GE Vernova (GEV) stock rises more than 6% after company raises outlook

International Airlines Group (IAG)

IAG share price has surged by over 130% in the last 12 months, beating some of the many airline groups. Its stock will be in the spotlight as the management publishes its earnings on Friday this week.

Unlike EasyJet, analysts expect the company’s results to be strong, helped by the transatlantic route. That’s because other similar airlines like United, Delta, and American Airlines have all published strong results.

The main issue will be the elevated jet fuel prices, the recent crisis in the Middle East, and the strikes in France.

Unilever (ULVR)

Unilever, one of the biggest Fast Moving Consumer Goods (FMCG) companies, has been under pressure in the past few months. It has plunged by over 7% from its highest level this year.

The company will be in the spotlight as it publishes its financial results next week. These results will provide more color on its business. Most notably, the company will detail the benefits of its recent acquisition of Dr Squatch, a men’s grooming company.

Other FTSE 100 shares to watch

There are more companies to watch in the coming week. The most notable of them will be AstraZeneca, one of the biggest companies in the UK. Its stock has remained under pressure this year and is down by about 10% from the year-to-date high.

The other notable FTSE 100 shares to watch will be Schroders, Aberdeen Group, Anglo American, Haleon, London Stock Exchange, Mondi, Rentokil Initial, and Helios Towers

The post Top FTSE 100 shares to watch: HSBC, Unilever, Rolls-Royce, IAG appeared first on Invezz